China from Deng (82) on, had two main plays.

The first play was a standard mercantalist export driven developing state. Low costs were used to create low cost goods primarily for overseas consumption. Foreign currency was plowed back into capital machinery acquisition. Foreign partners were given good deals and the decision makers become rich, but to play one had to give up intellectual property.

This is the standard industrialization sequences, followed by almost everyone, including Britain, Germany, the United States, Japan and South Korea.

It generally requires an already industrialized sponsor (Britain was an obvious exception to this, but the Dutch provided a similar service pre-industrialization.) For China that sponsor, from Deng on, was the United States: the US took the goods, sold the capital machinery, made profits and was generally pretty happy about the deal (just as Britain was while it sold its patrimony to the US for temporary profits.)

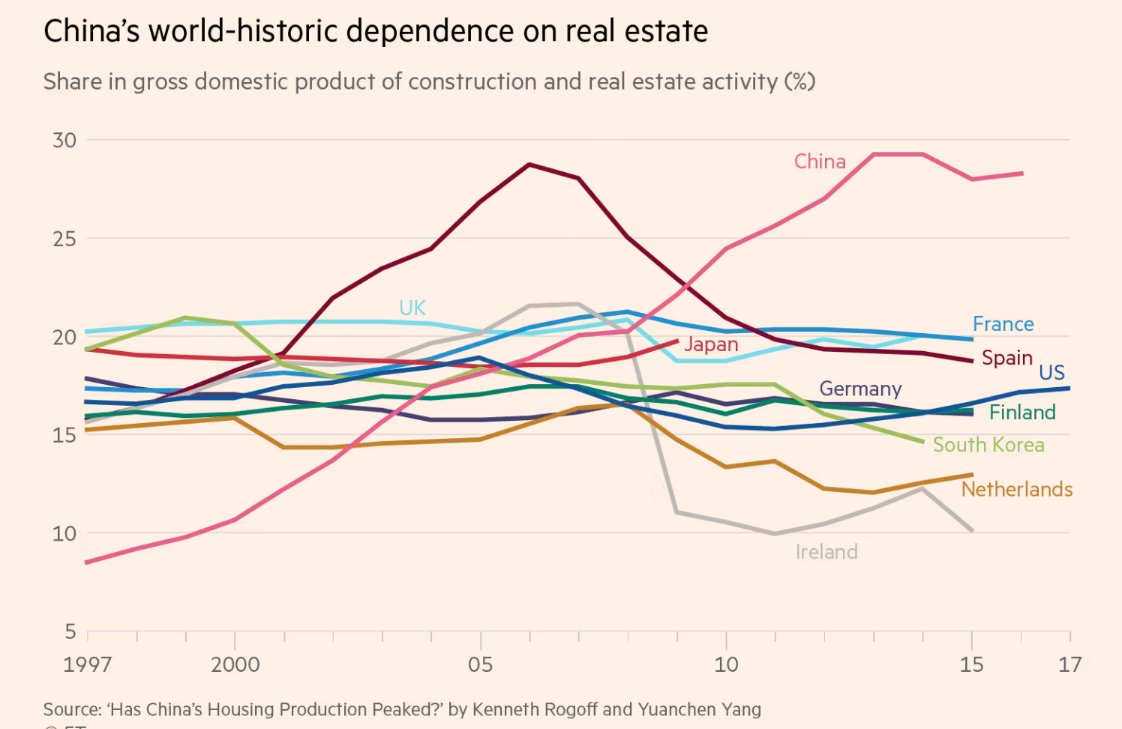

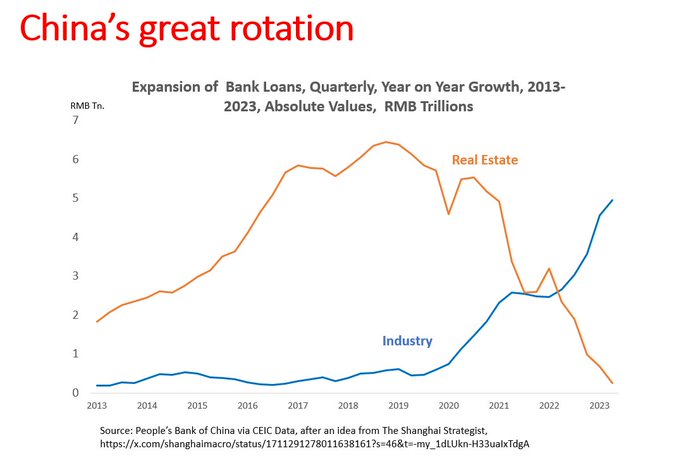

The second play was the housing driven internal capitalization market to make people at home feel good and fund local governments. Local governments (who control about 70% of the Chinese budget, far higher than any other major nation) oversaw massive development deals. Housing values rose, the governments made lots of money as they kept rising for decades. Similar to how for a long time now betting on rising real-estate prices in the US or Canada or the UK was a sure thing.

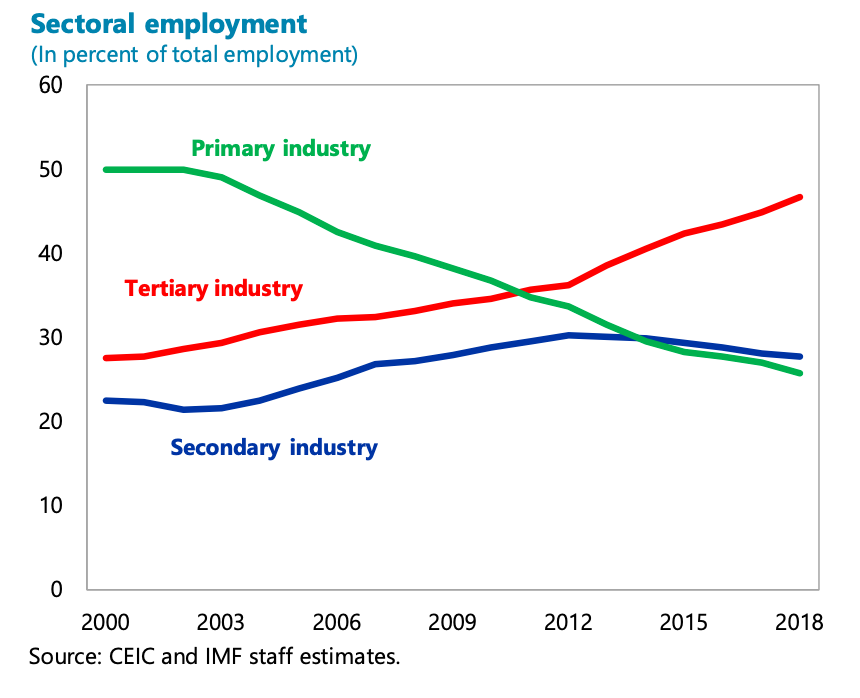

This synergized with moving peasants off the land and into factory and service jobs, which allowed for large commercial farms, seen as far more effective than small farms, let alone collectivized farms. (No one has been able to make collectivized farms work so far.)

This is standard, again, to industrialize you need a labor pool, and peasants tied to the land and ancestral villages aren’t free labor.

One problem with this play is that it is a “virtuous” or self-reinforcing cycle and it can get completely out of control (see above.) The second is that it makes local governments very dependent: they don’t want it to end, even though it leads to massive inequality and mal-distribution of resources.

But that chart shouldn’t be seen as entirely a bad thing: note that US housing prices are ludicrously high by restriction of supply. The Chinese ARE and did supply a lot of new housing. The problem is it now isn’t getting to people who need it.

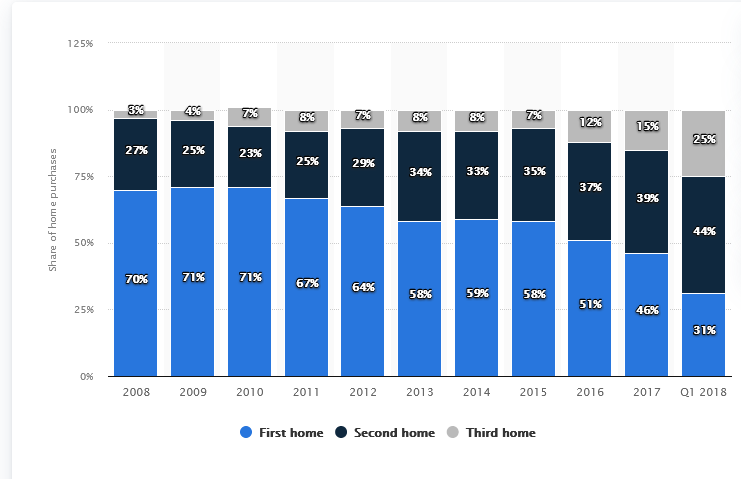

The above chart is pathological, and notice that it only goes to 2018. Anecdotally, young people in China, like in the US or Canada or the UK just can’t afford to buy a home unless their parents pay.

The second play, by the way, is often used independently. Turkey, for example, got about a decade and a half of prosperity out of it, but without the underlying “real” economy to support it, all it lead to in the end was inflation and economic weakness, because gains are always very unevenly distributed.

The problem with these two plays is that they are time bounded and lead to the middle income trap. They don’t develop a consumer economy, and income stagnates: far about undeveloped, but much lower than high income nations like the US, Japan and so on.

Likewise, these plays lead to extreme levels of inequality, as they did in the US during the gilded Age.

So, China had/has problems: high inequality; a gilded Age; housing which isn’t getting to those who need it. The social contract of “if you work and get a degree and so on, you’ll do well, is on the edge of breaking.”

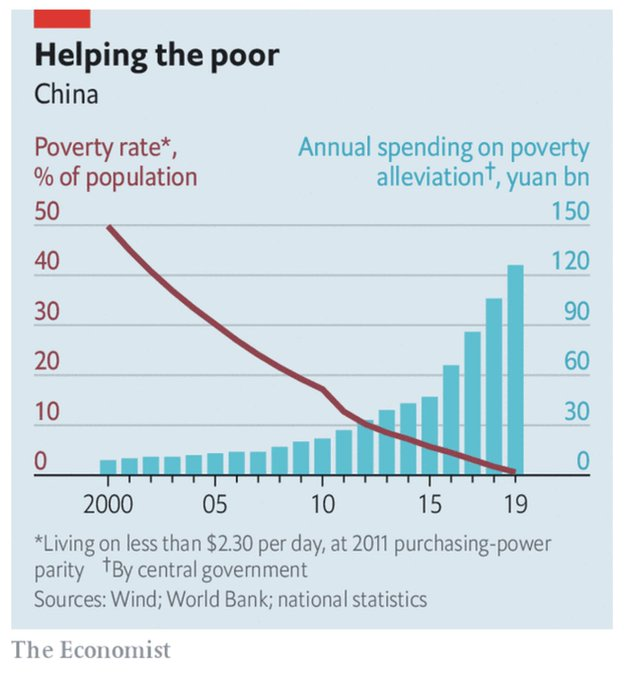

But they’re working on it. Some parts they’ve already somewhat solved.

Solutions

The first is poverty. The extreme poverty metric is garbage, but the chart still indicates that there’s a hell of a lot less poverty than there was even twenty years ago.

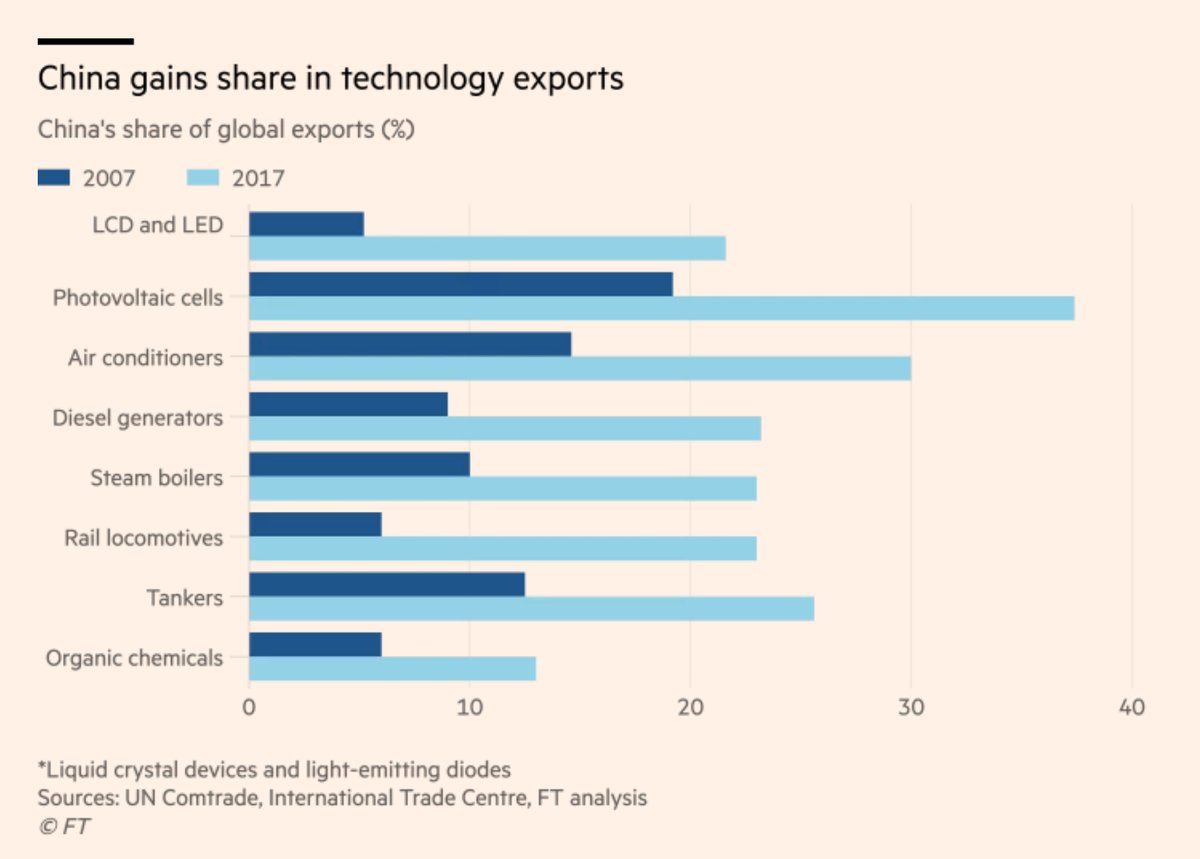

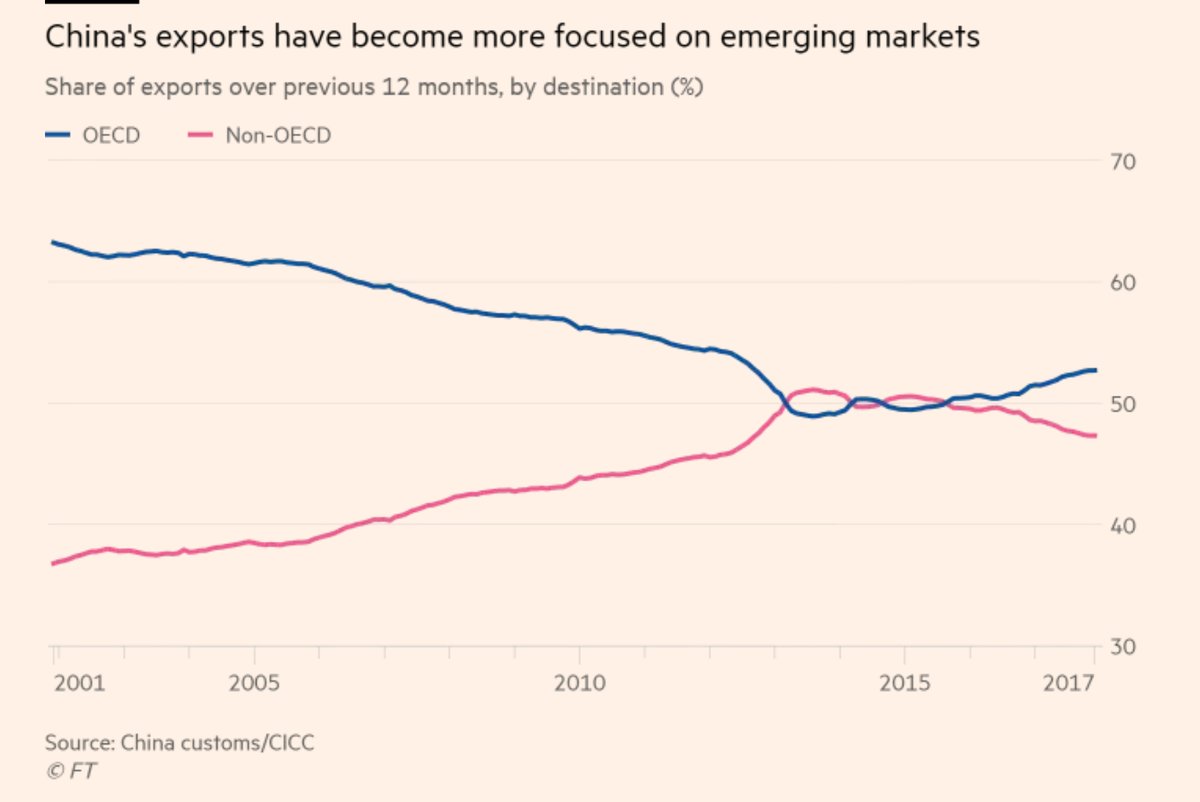

The second is what is called “moving up the value chain.” Countries which industrialize tend to recapitulate history, starting with textiles (the first industrialized goods.) But if you want to become a high income nation, you need to produce the highest value-add goods. China now does, and has even deliberately been moving out low value industry to other countries.

For a long time, if you wanted to buy advanced goods you had to go to the West, Japan, South Korea and Taiwan. That was it, and all of those are firm members of the “rules based order” or, really, of the US. Now you don’t, and China is absolutely eating the West’s lunch. France’s exports to its ex-African colonies, to name just one, have absolutely collapsed. China offers better deals with less political and military interference, and now that those nations don’t “need” France, they’re kicking France out.

But if the rest of the world doesn’t need to buy from the West, in the medium to long term, they aren’t going to sell to us, because we have so little they want. This where we move into Western collapse mode and is a large part of why, ex-climate change and environmental collapse, China would have already one, except perhaps for some shooting along the way. (Much like America’s ascendence was already baked in by 1900.)

Moving to a high income, goes in two phases: first you increase manufacturing, then you increase services. (Manufacturing is secondary industry, services are tertiary, and primary is resource extraction in the chart below.) Again, you can see China is making this transition, and blazingly fast, too.

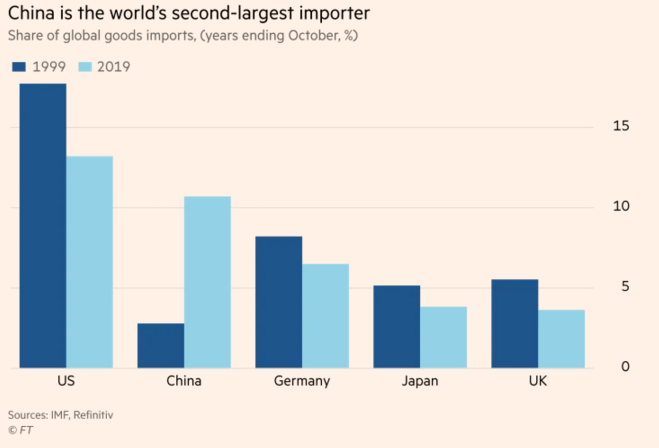

Key to being a high income nation is a consumer economy. While you want to create as much of the goods and services as you can domestically, there is always a transition from “living with what you have” and “spending almost all your foreign money on capital goods” to “we can now import stuff.” China is well on its way.

But China’s main issue now is the real-estate market. Prices are too high; it’s an investment and speculation vehicle; the people who need housing aren’t able to afford it, and since China has enough housing now, further investment is a mis-allocation of resources.

Which leads us to—

Boom. China is crashing the real-estate market. In the western press this is viewed as bad, an economic crisis, but it is necessary. Housing needs to become a commodity good, so that everyone can afford it and so that resources go to more needed areas.

And while making it to high income includes a lot of consumption, China has challenges which can only be met thru manufacturing, engineer and science. It needs to leap past the final western barriers in industries like semiconductors, biotech and aircraft. It has to transition to a clean electrified economy and prepare for climate change. (Really, to avoid a collapse, they have to build a massive sea wall along the northern coast, otherwise the northern breadbasket will wind up under water.)

From where I sit, China is doing most of its major economic policy correctly. Transitions are painful, and it is possible they’ll botch their transition, but these changes are necessary. Indeed, if the West is serious about re-industrializing, we need to do the same thing, with certain differences. We need to build more housing and collapse pricing, where they need to build less housing and collapse prices.

There’s more to write on China, in particular about climate change, demographics, Covid and so on, and we’ll return. But for now, this is the big picture.