This blog is for understanding the present, making educated guesses at the future, and telling truths, usually unpleasant ones. There aren’t a lot of places like this left on the Web. Every year I fundraise to keep it going. If you’d like to help, and can afford to, please Subscribe or Donate.

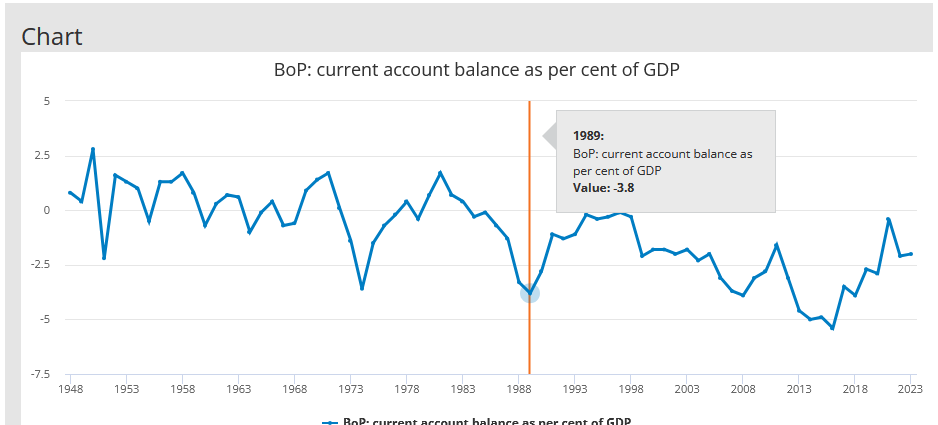

So, it’s clear from the response to my last post that some readers aren’t familiar with the effects of austerity on balance of payments and vice-versa. Balance of payments is, oversimplified, how much money is going in and out of a country.

When money goes into a domestic economy, if it is used to buy something that is imported, that effects balance of payments negatively.

If you’re selling more than you buy, which can mean services as well as good, then that helps balance of payments. It is also includes financial games: so if people are sending money to the London financial center, well, that improves BoP. London’s the world’s second largest financial center, after New York.

Now here’s the thing. Britain doesn’t grow enough food to feed its population. It doesn’t have a lot of industry left. North Sea oil is depleting, to the point that Britain became a net importer of oil in 2013. (Take a look at that chart.)

When the government spends money it isn’t magically siloed from causing import demand. The government cut back on heating subsidies, for example, and limited child support payments to two children. Without that money, oil and other demand is not as high as it would be otherwise.

Indeed, nothing is really siloed. If the government spends, almost always some of that money is going to go overseas and spike imports.

Britain controls its own printing press. It can print as many pounds as it wants, but it can’t make people in other countries take the money. The more they print, the less the pound will be worth, and the more inflation there will be because the dropping pound will increase prices of imported goods.

The pound is not the world trading currency any more. It hasn’t been since WWII. It can’t print pounds the way the US can print dollars and expect everyone to just take them.

Austerity is, in many ways, cruel and stupid, but if Britain (or Canada, or Australia, or even Europe) is to print money without it causing serious economic issues and to actually reindustrialize, it has to be done intelligently, along with serious industrial and domestic economic policy. (Currently tons is printed, but siloed to the rich, which keeps general demand from exploding but destroys markets’ ability to function properly.)

Now the thing is that Britain is a high cost of living economy: food and housing are expensive. Very expensive. Workers need to be paid well to survive, and that makes Britain un-competitive against lower cost (or higher productivity) countries.

If you wanted to make Britain competitive again, you’d have to crash housing and rent, to start. You can imagine how politically fraught that is: people who have high net worth due to real estate aren’t going to like it.

Then there’s the issue of the City, the financial center. Financial center profits are HIGH. That’s a problem, because people would rather put money into finance than into industry or farming or whatever since returns are better. Finance cannibalizes the rest of the economy. So you have to weaken the city and silo it, and probably tax it a lot. That’s hard to do, because the City has a lot of power, and there’s a real issue because it does, actually, bring a lot of money in to Britain, it’s just that money doesn’t get spread around.

When you industrialize, or re-industrialize, you have to make sure that money in the domestic market buys domestic goods, doesn’t buy a lot of foreign goods, and is used primarily on industrialization: capital goods, primarily. It’s unpleasant, it means a lot of goods (imported goods) aren’t available or are very expensive. Your new industry, ideally, either serves the domestic market, or is good for export, or both.

Austerity doesn’t exist just because governments are run by stupid psychopaths (though that’s part of it), it exists because of very real constraints caused by a need to send more money out of the country than is coming in to the country. In the seventies the UK was in so much trouble it had to actually go to the IMF for help, and join the EU so Europe would help it bail out.

Now, again, there are ways around this, but they require taking on powerful interests and hurting a big chunk of the population, especially in the short to medium term (about twenty years or so.) It means, as much as possible, making do with what you can produce yourself, and when you can’t, going cheap. No foreign fresh fruit imports, except the cheapest (hope you like bananas.) Cheap phones and appliances. Etc…

It also means ending all sorts of stupid financial games: no more Private Equity. No stock buybacks. No huge stock option grants. You want money reinvested. Currency controls so money doesn’t flood out. Possibly a dual currency.

All of this is painful. But if you don’t do it, decline inevitably continues and eventually you’re back to being a third world country.

Austerity is a pressure bandage on a wound that still won’t stop bleeding. It slows down the decline, but it doesn’t heal the wound.