Reading

Michael Hudson | A piece of advice: Buying U.S. debt is to provide ammunition for U.S. military expansion Source: Observer Network 2023-06-01 08:01 The June 5 deadline referred by US Treasury Secretary Janet Yellen has fallen, and the US debt ceiling negotiations have entered the final congressional voting juncture. House Speaker McCarthy, who was eager Continue Reading

The post Buying US Debt Subsidizes Imperialism first appeared on Michael Hudson.Netanyahu's new political agenda is motivated by his own survival, at the expense of peace and stability in the region.

The post Gangster Diplomacy: How Netanyahu is Provoking Armed Intifada in the West Bank appeared first on MintPress News.

Residents of Sesame Street,

Thanks to all of you who have stopped by these past two days to say hello, howdy, or hola, and then asked for honey. Thank you also to our repeat customers who came in the next day saying greetings, or good day, and then asked for grapes. Your combined ability to use the same letter of the alphabet in your salutations and searches for items is truly impressive.

Each of you has also been incredibly kind in welcoming us and asking questions. All sorts of questions. Questions that our experienced retail grocery team has never had to answer before. So while we try to remain as helpful as possible, please be patient if we cannot answer questions such as how bubbles are formed, why people have different hair colors, and how butterflies fly.

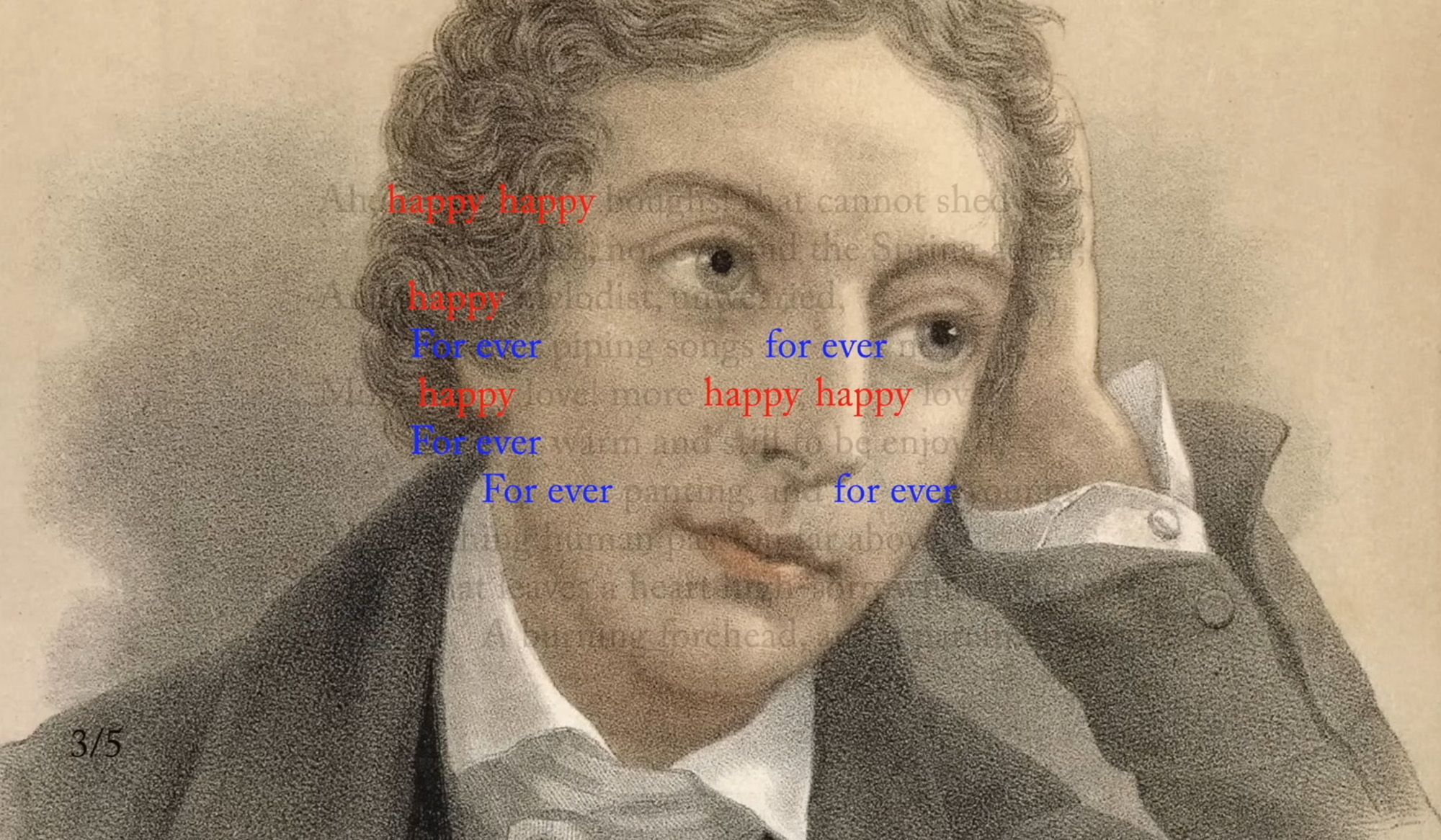

- by Aeon Video

- by Monica Westin

- by Pranay Sanklecha

The Grayzone participated in what appears to be the first independent expedition investigating the sabotage of the Nord Stream pipelines. Near one of the blast sites, we discovered a diving boot used by US Navy divers. How did Swedish investigators miss this? Video above by Agnes Andersson On the evening of May 24, 2023, I stood aboard a small ship called the Baltic Explorer. With sun still high overhead in the Baltic Sea, our boat sat anchored thirty-one nautical miles […]

The post Independent Nord Stream expedition discovers clue missed by official investigators first appeared on The Grayzone.

The post Independent Nord Stream expedition discovers clue missed by official investigators appeared first on The Grayzone.