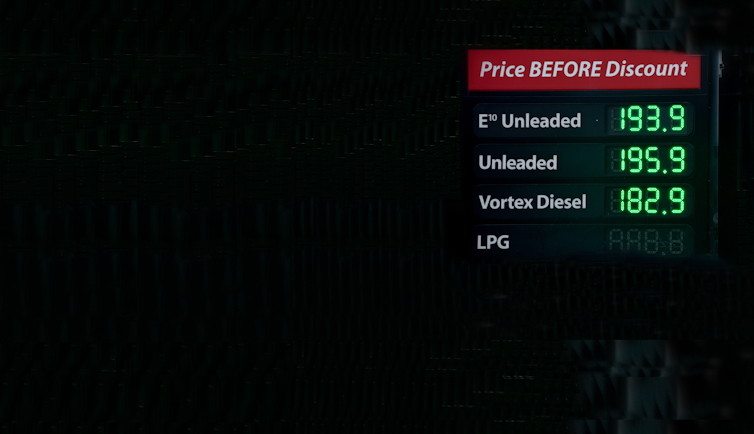

No one likes paying A$1.80 per litre for petrol. But amid forecasts of prices climbing to $2.10 as Russian’s invasion of Ukraine drags on, it’s possible some good could come of that pain – including greater energy independence and a faster path to net-zero emissions.

Two months ago, at the start of 2022, the typical Sydney and Melbourne unleaded price was $1.60 a litre. A year earlier, at the start of 2021, it was $1.20.